Contents

We think cryptocurrencies will likely exist alongside, rather than in place of the deeply entrenched, liquid fiat currencies. In the long run, it may be the underlying concept and blockchain technologies that prove revolutionary. Technical analysis is valuable in crypto investing even if you don’t have access to years of historical price data in the Terra chart. For example, with many cryptos, dramatic price drops and periods of high volatility have been followed by a sustained rise to new highs. There’s no guarantee that the pattern will be sustained in the future, but if it has been consistent in the past, it’s worth considering.

The listing date is typically one or more days after the fund inception date. Therefore, NAV is used to calculate market returns prior to the listing date. We believe these drivers of cryptocurrency markets will likely continue in the coming years, but this does not necessarily validate investing in cryptocurrencies on a standalone basis. The infrastructure is still young and susceptible to various risks even beyond adoption concerns, including legal and regulatory.

Sustainable

Crypto Listing Application Make your crypto project coinspot trustpilot available to 3+ million people on Bitpanda.

We have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public sources. Volatility is a measure of variation of a financial instrument’s price. New Bitcoins come into the system through a process called “mining,” where these “miners” verify transactions on the blockchain by solving its complicated math problems, called hash functions. Yet the amount of Bitcoin rewarded by solving these functions is reduced by half every four years, purposefully slowing the rate at which new Bitcoins are mined or circulated. As Exhibit 1 shows, the history of Bitcoin has been eventful. Its price has been volatile and driven by many different factors over time.

Using a private version of the public, open-source XRP Ledger, Central Banks can use a secure, controlled and flexible solution for the issuance and management of digital currencies. Of retail investor accounts lose money when trading CFDs with this provider. Neither the author nor editor held positions in the aforementioned investments at the time of publication. We believe everyone should be able to make financial decisions with confidence.

Subscribe to our mailing list to help turn the wheels of change

Platforms that buy and sell cryptocurrencies can be hacked, and some have failed. In addition, like the platforms themselves, digital wallets can be hacked. The Bloomberg Barclays US Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds, and mortgage backed and asset-backed securities.

- There is no doubt we are experiencing some of the most adverse investment conditions over the last decade.

- You can also leave the money in your available funds if you don’t want to reinvest in a bot yet; this saves transfer costs.

- The company is the leader in strategies such as dividend growth, interest rate hedged bond and geared ETF investing.

- When we look globally, we see a lot of concerns around supply chain fragility, economic resilience, reshoring manufacturing, re-localising supply chains, and energy independence.

- We believe these drivers of cryptocurrency markets will likely continue in the coming years, but this does not necessarily validate investing in cryptocurrencies on a standalone basis.

Currently, there is a common narrative in the media that growth suffers in a rising interest rate environment. Looking back to the early 1990s, there have been four US Federal Reserve interest rate tightening cycles and in three of those four, growth outperformed value. In addition, technology was often the best sector to invest in during those four periods. While growth may not outperform value this time, we do think it is important Know how to start drone software development to point out that this narrative is detached from recent history. In terms of inflation and the rate of change of interest rates, which is currently worrying markets, we believe this should be viewed as a move back towards normalisation. From a relative perspective the increase in interest rates is significant given the starting point of close to zero but, taking a step back, interest rates are still at multi-decade lows .

One platform, all business lines

Sustainability is closely linked to innovation and we seek businesses that are transforming the world for the better. An obvious example is the renewable energy sector and related development projects. As oil and gas prices rise, the number of projects that can generate acceptable returns increases. More broadly, we are witnessing greater demand for many renewable projects. Cryptocurrencies have once again piqued investor interest after posting robust returns in 2020. Heightened speculative sentiment, hopes of hedging against equity downsides and inflation risk, and the development of digital assets may all have contributed to new heights for cryptocurrency prices.

As an active member of the XRP community, Ripple believes in information transparency. To learn more about quarterly sales and escrow activity, read the latest trade99 review XRP markets report. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Bitcoin and bitcoin futures are a relatively new asset class and the market for bitcoin is subject to rapid changes and uncertainty. Bitcoin and bitcoin futures are subject to unique and substantial risks, including significant price volatility and lack of liquidity. The value of an investment in the ETF could decline significantly and without warning, including to zero. ProShares now offers one of the largest lineups of ETFs, with more than $55 billion in assets.

They are not traditional currencies, which are defined as an effective medium of exchange, with fundamental (or government-backed) value and relative stability. In our view, cryptocurrencies also lack the properties of an asset class. They do not generate cash flow or earnings through exposure to global economic growth.

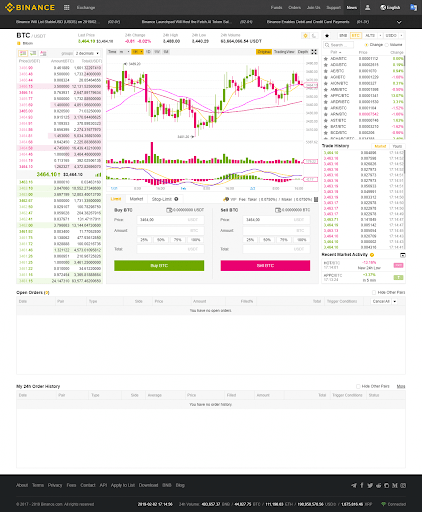

Trading

Fast and green, the digital asset XRP was built to be the most practical cryptocurrency for applications across the financial services space. Stocks as an investment class have a much longer history than cryptocurrencies. If you’re used to evaluating stocks based on companies’ financial performance, you may be more comfortable with stocks. Our focus has always been to seek companies with proven business economics and cash flows. Many sustainable companies offer strong compounding potential because they provide solutions to key societal and environmental challenges.

The company is the leader in strategies such as dividend growth, interest rate hedged bond and geared ETF investing. ProShares continues to innovate with products that provide strategic and tactical opportunities for investors to manage risk and enhance returns. It is important to note that we are long-term investors, which means not reacting to short-term trends, notably the sector moves and style rotation we are currently experiencing. As noted above, we believe the trends we have built our approach around remain very much in place and, if anything, have accelerated. When we look globally, we see a lot of concerns around supply chain fragility, economic resilience, reshoring manufacturing, re-localising supply chains, and energy independence. These play into the sustainability trends that we are focused on.

Why is the live Terra price different on different cryptocurrency exchanges?

Is a digital file secured by cryptographic technology that makes it difficult to duplicate or alter without its owner’s permission. Cryptocurrencies are not sold on the stock market but on crypto exchanges that decide which assets to list. In addition, certain cryptocurrencies provide users with a share of governing power over the underlying network on which they operate. However, issuing a cryptocurrency is more of a technical endeavor than a regulatory one, and the amount of financial data available to the public can vary. Energy stocks have been some of the big winners this year and sustainable investment approaches, such as our own, that do not offer exposure to oil and gas companies have been negatively impacted.

To start a bot, click the bots button at the bottom of your screen. Click the start this bot button and select the amount you want to deposit. It doesn’t matter if you’ve never heard of cryptocurrencies or if you’re a seasoned investor. BOTS is designed to be quick and easy to understand without any in-depth knowledge. Monitor a bots performance for free or invest directly from €5.